DCA vs Lump Sum: Which Strategy Actually Works for Crypto Investing?

Isabelle Rowan

Lead Researcher, Clarity

Most investors asking about DCA vs lump sum are not trying to optimize returns by a few percentage points.

They are trying to avoid a very specific pain.

The pain of putting money into crypto at the wrong time, watching the market collapse, and realizing that a single decision just defined years of results.

Crypto amplifies this fear because timing feels everything. Volatility is extreme. Drawdowns are violent. Recovery is uneven. And the difference between a good entry and a bad one can feel existential.

That is why the DCA vs lump sum debate exists in the first place.

The problem is that most discussions around it are shallow. They focus on preference, personality, or blanket advice instead of how these strategies actually perform under real market conditions.

If crypto is going to be treated as an investment, this question deserves a real answer.

What DCA and Lump Sum Actually Mean in Crypto

Before comparing outcomes, definitions matter.

Dollar-cost averaging (DCA) means deploying capital gradually over time, regardless of price. The goal is not to time the market but to smooth entry and reduce regret.

Lump sum investing means deploying all available capital at once, accepting short-term volatility in exchange for maximum exposure.

In traditional markets, this debate already exists. In crypto, it is intensified because volatility is not a rounding error. It is the defining feature.

The real question is not which strategy feels safer.

The question is which strategy has historically produced better outcomes, under what conditions, and at what cost.

Why the DCA vs Lump Sum Debate Exists at All

This debate exists because crypto behaves differently from most asset classes.

Crypto markets are cyclical, reflexive, and sentiment-driven. Prices overshoot both directions. Drawdowns of 70 percent or more are not rare events. They are part of the structure.

Because of this, entry timing has an outsized psychological impact. Even long-term investors struggle to hold through extreme volatility if they enter poorly.

DCA exists as a response to this reality. Not as a performance hack, but as a behavioral one.

Lump sum exists because exposure matters. In strong uptrends, time in the market dominates entry finesse.

Both strategies exist for valid reasons. Neither is universally superior.

What the Data Says About DCA vs Lump Sum in Crypto

When you move past opinions and look at historical performance, a few patterns show up consistently.

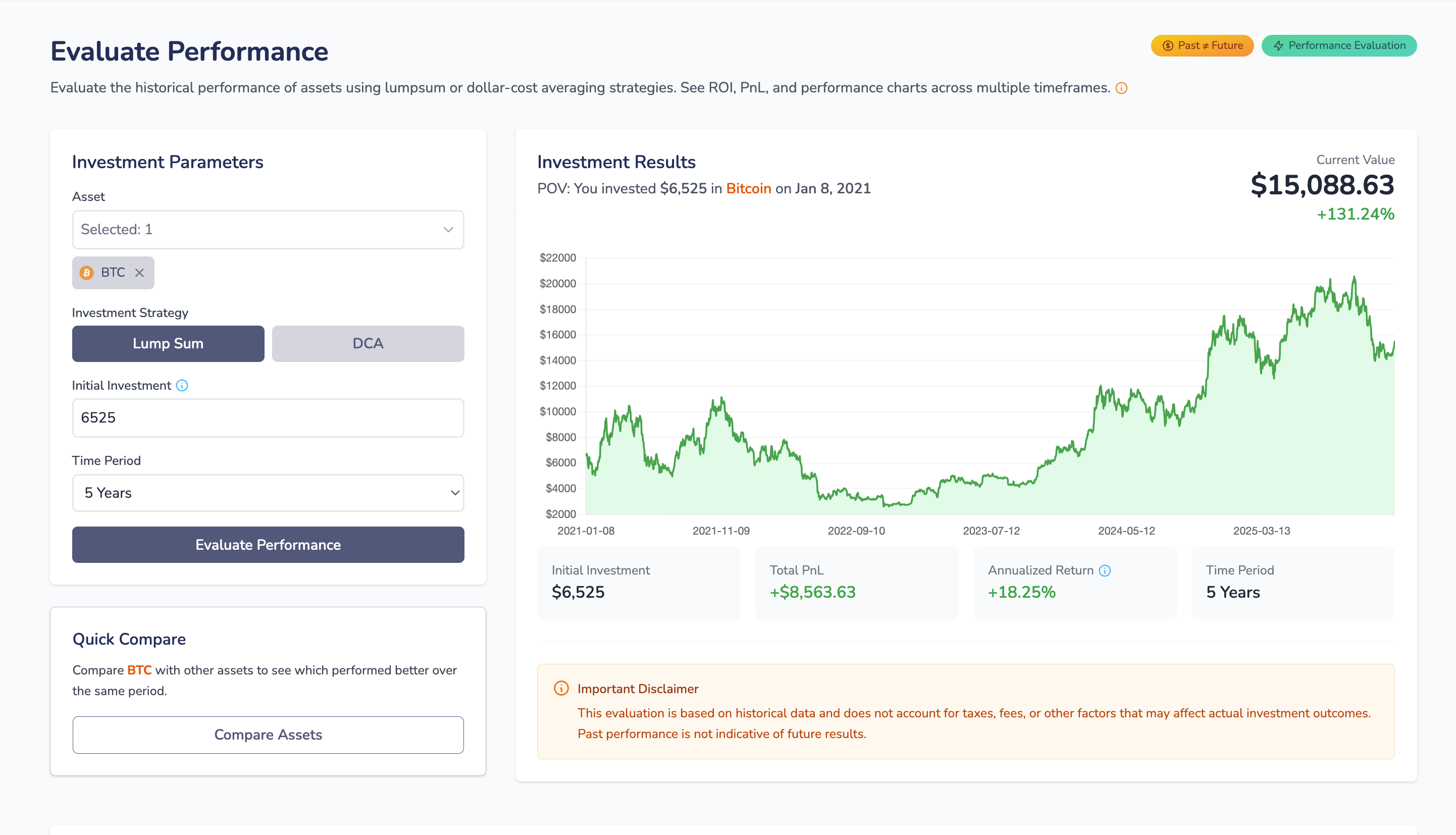

Over long periods, lump sum investing tends to outperform DCA in absolute return, assuming the investor holds through full cycles.

This happens because crypto has spent more time rising than falling over its lifespan, especially for dominant assets. Earlier exposure captures more upside.

However, that outperformance comes with a cost.

Lump sum investors experience deeper drawdowns, sharper volatility, and much higher psychological stress. Many do not actually hold long enough to realize the theoretical advantage.

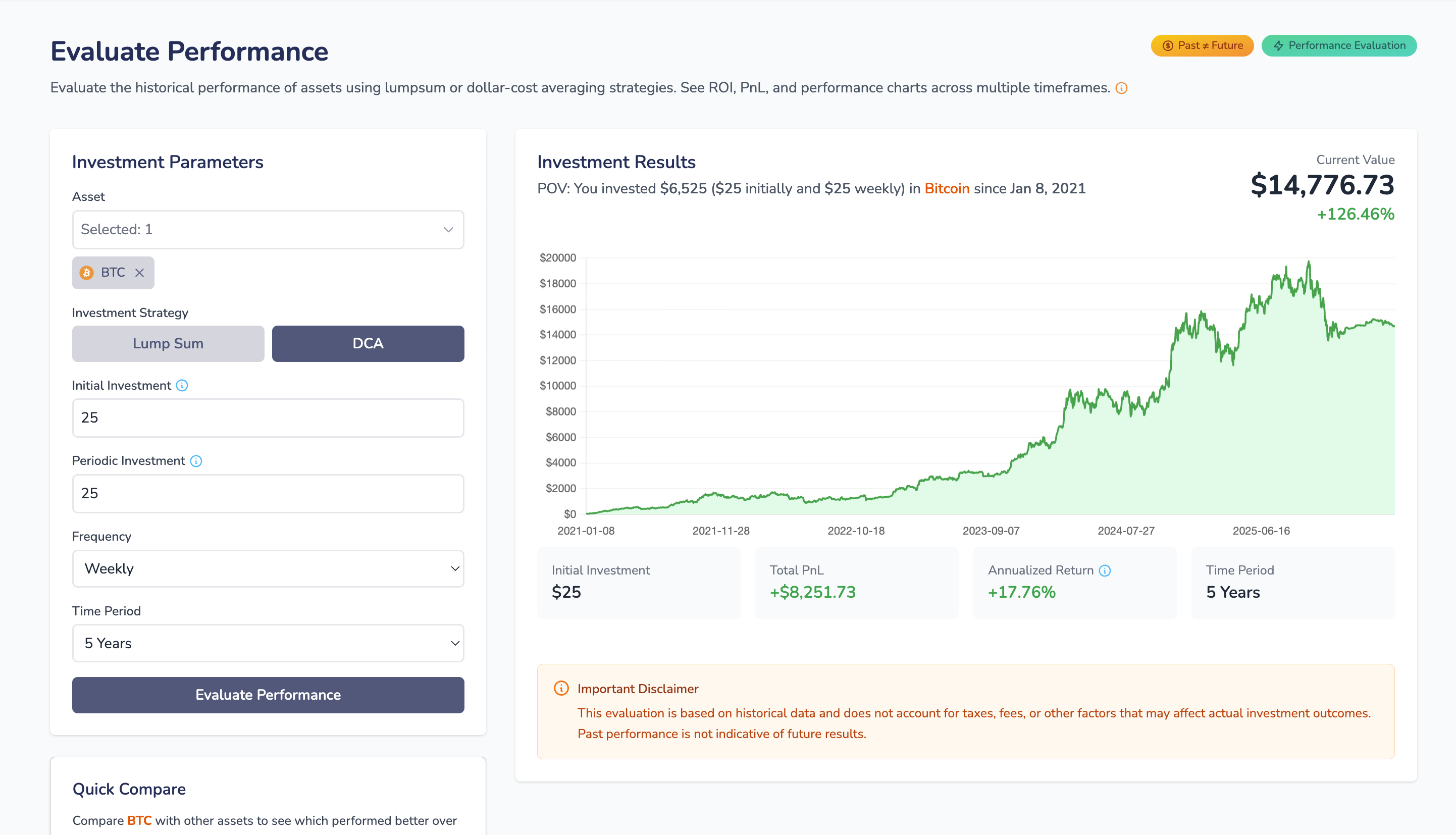

DCA, on the other hand, tends to produce smoother entry curves. It reduces the impact of unlucky timing and lowers the emotional load of volatility.

The trade-off is opportunity cost. In strong uptrends, DCA often underperforms because capital is deployed too slowly.

This is not a debate between right and wrong. It is a trade-off between exposure and endurance.

How Often Crypto Crashes Changes the Equation

Crypto does not drift downward gently. It collapses.

Major assets have experienced multiple drawdowns exceeding 70 percent. Many smaller assets never recovered at all.

This matters because strategy performance is not just about returns. It is about survivability.

Lump sum investing into crypto before a major drawdown can take years to recover. DCA during that same period often results in a much healthier cost basis.

This is why many investors who understand the math still choose DCA. Not because it maximizes returns, but because it increases the probability of staying invested long enough for returns to matter.

A strategy that looks optimal on paper but fails behaviorally is not optimal in practice.

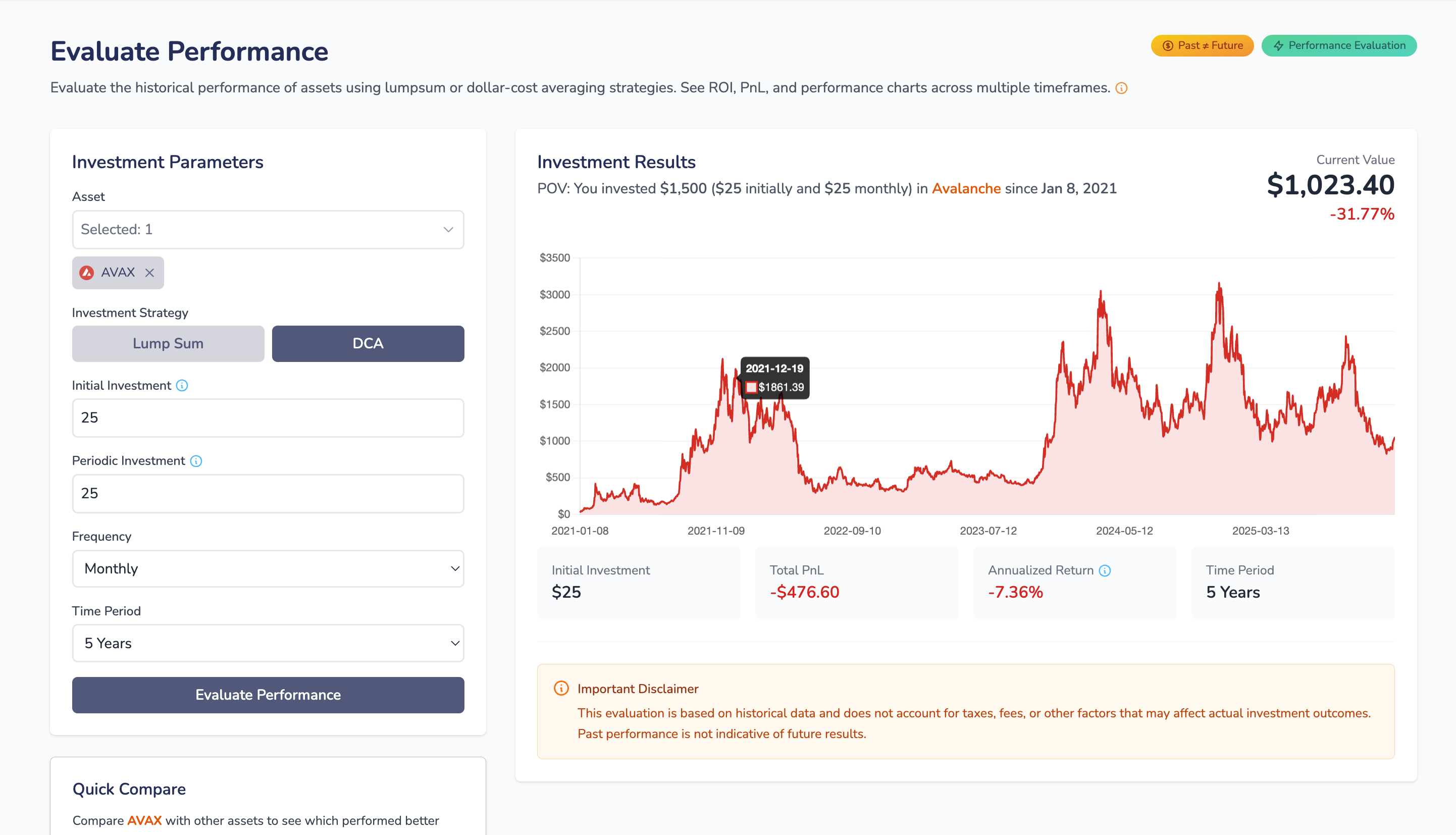

Strategy Matters Less Than Asset Selection

One of the biggest misconceptions in crypto investing is that strategy can compensate for poor asset choice.

It cannot.

Both DCA and lump sum perform dramatically better when applied to assets that have survived multiple market cycles and demonstrated long-term resilience.

They both fail when applied to assets that rely on narratives, hype, or short-lived momentum.

This is why debates about DCA vs lump sum often miss the real driver of outcomes.

Asset selection dominates strategy.

Timing helps. Discipline helps. Strategy helps. But none of them rescue weak assets over the long run.

Long-Term Crypto Investment Is About Process, Not Precision

Investors often search for the perfect answer to DCA vs lump sum because they want certainty.

Crypto does not offer certainty. It offers asymmetry.

The role of strategy is not to eliminate volatility. It is to make volatility survivable.

DCA tends to work best when:

- Volatility is extreme

- Entry timing is uncertain

- The investor values consistency over optimization

Lump sum tends to work best when:

- The investor has high conviction

- The time horizon is long

- The investor can tolerate deep drawdowns without reacting

Neither strategy fixes emotional decision-making. Both require discipline.

Why Backtesting Matters More Than Advice

Most advice about DCA vs lump sum is generic because it is not grounded in real performance analysis.

What actually matters is how these strategies performed for specific assets, over specific periods, under real market conditions.

This is where most investors guess instead of verify.

Being able to evaluate historical performance using both DCA and lump sum approaches changes the conversation entirely. It replaces belief with evidence.

Evaluate Historical Crypto Performance

See how DCA and lump sum strategies actually performed for real crypto assets over time.

Explore Historical Performance →It also reveals something uncomfortable.

The same strategy can look brilliant or disastrous depending on the asset, the timeframe, and the market regime.

That variability is not a flaw. It is the reality of crypto investing.

Understanding Profit, Not Just Returns

Returns alone do not tell the full story.

Two investors can earn the same return with radically different experiences, drawdowns, and capital paths.

Understanding profit means understanding:

- How capital was deployed

- When exposure increased

- How drawdowns affected position value

- How long recovery took

This is why evaluating outcomes through both DCA and lump sum lenses is critical. It shows not just what happened, but how it happened.

Tools that calculate crypto profit across different strategies are not about prediction. They are about clarity.

Calculate Your Crypto Profit

Use our profit calculator to simulate DCA vs lump sum for any crypto asset and see potential outcomes.

Try Crypto Profit Calculator →So Which Is Better: DCA or Lump Sum?

The honest answer is this:

Neither strategy is superior in isolation.

Lump sum maximizes exposure. DCA maximizes endurance.

The better strategy is the one you can execute consistently, on strong assets, over a long enough horizon for compounding to matter.

Crypto rewards patience, not cleverness. It rewards process, not precision.

The Real Edge Is Seeing the Trade-Offs Clearly

Most investors do not fail because they choose DCA instead of lump sum, or the other way around.

They fail because they never understood the trade-offs they were accepting.

When you can see how different strategies would have performed historically, across real market cycles, decisions become calmer and more rational.

That is the point.

Not to find a magic strategy, but to invest with clarity instead of hope.

If crypto is going to be part of a serious portfolio, it deserves that level of honesty.